As highlighted in the Spring Budget 2021, The Coronavirus Job Retention Scheme (CJRS) has been extended until 30 September 2021.

The level of grant available to employers will stay the same until 30 June. From July 2021 however, there will be a phased reduction in support.

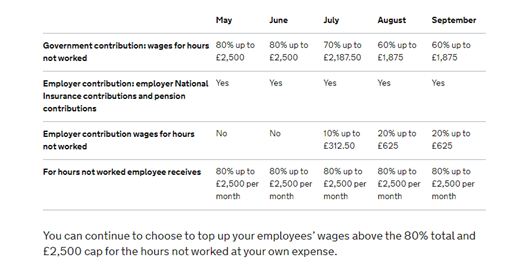

While the furlough grant for May and June will remain at 80% of an employees’ usual pay for hours not worked, from 1 July 2021, this will go down to 70%. This will then be further reduced to 60% for August and September when the scheme will end.

This phased reduction will operate in a similar way to how it was running in September and October 2020. This will mean that employers will need to contribute the remaining 10% and then 20% of their employee’s regular pay, so that they continue to receive 80% pay for any furloughed hours.

In addition to the 10% and 20% contributions, employers will continue to be responsible for paying National Insurance and pension contributions on the full amount being paid to employees.

To be eligible for the grant, you must continue to pay your furloughed employees 80% of their wages, up to a cap of £2,500 per month for the time they spend on furlough.

The table below shows the level of government contribution available in the coming months, the required employer contribution and the amount that the employee receives per month where the employee is furloughed 100% of the time.

Wage caps are proportional to the hours not worked.

You can find all the most up-to-date information about the scheme on the gov.uk website.

If you would like help making a claim or working out an estimate for the CJRS, please don’t hesitate to get in touch with PKB and we’ll be happy to help.

To read news and blogs from Rebecca Austin, click here >>